Vieriu/Adobe Stock

You’ve found a flight for $350 and now you’re stuck in the classic loop: should I buy this flight now or wait? Will flight prices go down if you wait a few days, or is this exactly the moment when the airline quietly pushes the fare up?

The truth is, you can’t know the future price with 100% certainty. But airlines don’t change fares at random. They follow clear patterns based on demand, seasonality, time until departure, and how fast seats are selling. If you understand these patterns, you massively increase your chances of getting a good deal instead of overpaying.

In this guide, we’ll walk through how to know if a flight price is likely to go up or down, give you a simple decision framework (buy now or wait), and show how flight price prediction tools can help you make smarter, calmer booking decisions.

Why Flight Prices Change All the Time

If you’ve ever thought “why are flights so expensive right now?”, the answer is almost never because the airline is greedy today. And definitely not “because of your cookies”. Airlines use dynamic pricing. Automated systems update fares based on demand, season, time left until departure, and competition on the route.

One of the most common myths is the idea that cookies control prices, as in “do cookies make flight prices go up”. In practice, fares move because seats are being sold, demand changes, or the airline updates its rules, not because you searched a few times from the same browser.

The main factors that move the price are:

-

Time until departure. Cheaper fare buckets sell out first; closer to the date, only higher fare classes remain.

-

Demand for that route and date. Holidays, school breaks and big events push prices up and sell out cheap seats faster.

-

Seasonality and day of week. Summer, Christmas and long weekends are usually more expensive than quiet shoulder seasons and midweek flights.

-

Competition and alternative routes. Several airlines and airports on the same route usually keep prices in check; a monopoly gives the airline more freedom to raise fares.

-

External shocks. Strikes, fuel costs, geopolitical events or sudden demand spikes can trigger sharp price changes.

You do not need to become a revenue management expert. This basic picture is enough to use these factors as a checklist later in the article when you decide whether to buy now or wait.

When Flight Prices Usually Go Up vs Down

Now that we have covered dynamic pricing and how airlines think about fares, let us look at when a price is likely to drop and when it is more likely to go up. You can use these factors when planning your trip to decide whether to buy now or wait.

When prices usually go up

Prices are more likely to go up when:

-

You are close to departure. Inside roughly the last 7 to 14 days for short-haul and 2 to 3 weeks for long-haul, the cheapest fare buckets are often gone. If you are asking “do flight prices go down closer to departure”, the honest answer for most routes is no.

-

The current price is already low. If today’s fare is clearly cheap compared with nearby dates or what is typical for this route and season, there is usually more room for prices to rise than to fall further. A simple way to check this is to use a low fare calendar to see whether this fare sits in the low, typical or high range.

-

You are flying in peak season or around big events. Summer holidays, Christmas or New Year, school breaks, major conferences or festivals drive demand and push fares higher. For example, when Palmeiras reached the Copa Libertadores final in Lima, São Paulo to Lima flights for that weekend became roughly two to three times more expensive than on nearby dates.

-

There is little or no competition. If there is only one airline on the route, no nearby alternative airports, or no low-cost carriers operating there, the airline has much less pressure to discount and much more freedom to raise fares.

In these situations, waiting usually just means paying more for the same seat.

When prices can go down or stay stable

Prices can go down or stay flat when:

-

You are still far from departure. Booking several months ahead, outside peak dates, leaves room for promotions or fare adjustments.

-

There is plenty of competition and flexibility. Several airlines, nearby airports or many flights per day increase the odds that someone will lower fares.

-

The current price looks high for this route or season. If tools show that today’s fare is above the typical range, there is more room for a drop than for another big jump. In that case, wondering when flight prices will go down is reasonable.

If several of these factors line up at the same time, that is a strong signal the price is likely to fall, so it can make sense to wait. This works in most situations, even though there will always be exceptions.

How a Flight Price Predictor Helps You Decide

Instead of manually analysing every route, you can use tools that already factor in the main drivers of price changes. Their algorithms take into account seasonality, demand, time until departure and competition, and turn all of that into a simple buy versus wait signal.

AirTrackBot

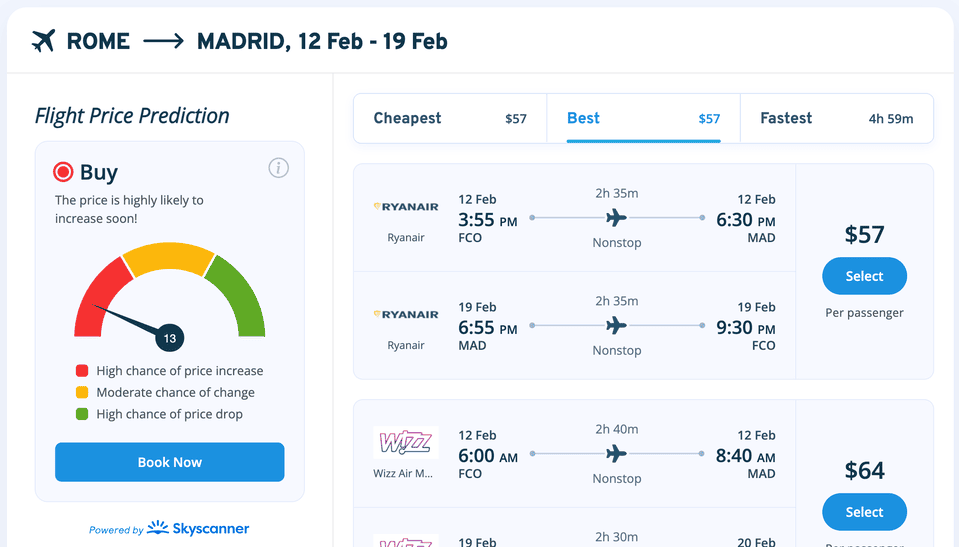

On the AirTrackBot site you enter your from and to plus dates, and within a few seconds you get a list of flights for your route. On the left there is a prediction panel with a gauge and a clear recommendation, for example Buy or Wait.

In this example we are looking at Rome to Madrid for 12 to 19 February. There are around 80 days left until departure, but the current fare of $57 is already among the lowest for this route in the coming months, so the algorithm marks a high chance of a price increase and recommends buying now.

Skyscanner

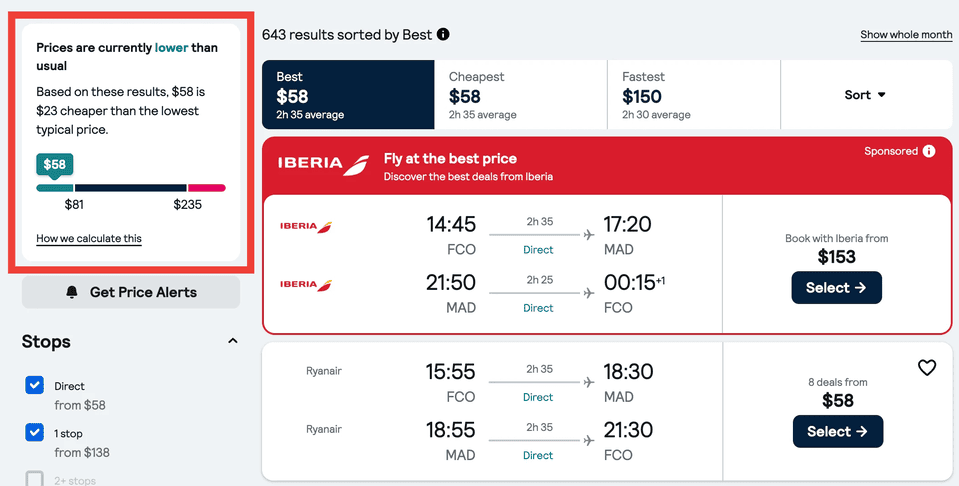

Skyscanner does something similar. To help you see whether it is a good moment to buy, it shows a price insight box. It tells you if prices are lower than usual, typical or higher than usual, how today’s fare compares to the usual range for this route, and highlights the current fare on a bar between the typical low and high prices.

Google Flights

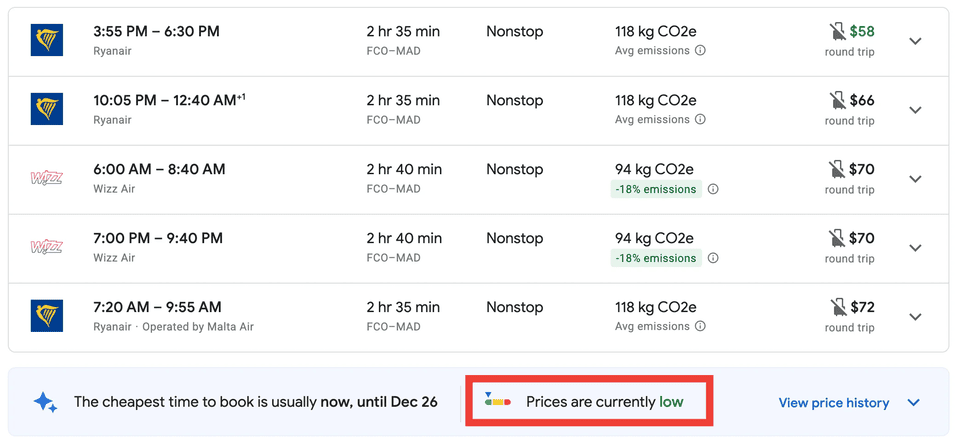

Google Flights works in a similar way. Under the results it shows an info bar with messages such as “Prices are currently low” and a link to view price history. It is not a full flight price predictor, but it clearly shows that today’s fare is among the lowest for this route and acts as a strong “this is a good moment to book” signal.

All these tools do the same thing for you: they turn raw numbers into an easy signal about whether the current price is low, typical or high, so you spend less time guessing and more time making a clear buy or wait decision.

Conclusion

You will never know with 100 percent certainty what a fare will do next. But you can stop guessing blindly.

If you understand when prices usually go up, when they can go down or stay stable, and how far you are from departure, you already have most of the answer to the question of how to know if a flight price will go up or down. A flight price predictor or tools like AirTrackBot, Skyscanner and Google Flights add the missing piece: they show whether the current fare is low, typical or high and give you a simple buy or wait signal.

Use the checklist from this guide, check what your tool says, and decide based on your own risk tolerance. If the price is good for your budget and marked as low or typical, it is usually better to book and move on than to chase a perfect price that may never appear.

FAQs

Do flights get cheaper closer to the date?

Most of the time, no. For many routes, prices tend to be lowest roughly a few weeks to a few months before departure, then either stay flat or rise as the plane fills. Data from fare trackers and agencies show that domestic flights are often cheapest around 1 to 2 months out and international flights around 2 to 4 months out, rather than in the last days before departure.

Last minute drops do happen, but they are exceptions, usually on routes that are still underfilled or on very flexible charter and low-cost inventory. Relying on a last minute bargain is closer to gambling than to a strategy.

Do flight prices go up or down closer to departure?

As you move into the last weeks before departure, prices more often go up than down. Airlines use revenue management to protect late seats for business and last minute travellers who are less price sensitive, so the cheapest fare classes are usually sold out by then and only higher buckets remain.

Prices can still move day by day, but if you are inside the last 7 to 14 days for short-haul flights or 2 to 3 weeks for long-haul flights, the general expectation is higher, not lower.

Will my flight price go down tomorrow?

No one can tell you with certainty what will happen tomorrow to a specific fare. Short-term moves are noisy: the price can go up, down or stay flat by a few percent without any obvious reason.

Instead of guessing day by day, focus on the bigger picture: how far you are from departure, whether this is a peak period, how the route normally behaves, and what tools say about the current level compared to typical prices. Using alerts is usually more effective than checking manually every morning.

Is it better to wait to buy flights?

It depends on timing and the current price level. If you are many months out, not in peak season, and the fare looks high compared to typical prices for the route, waiting with alerts often makes sense. If you are already in the usual booking window for that market and you see a fare that is low or typical, waiting only to save a few extra dollars carries a real risk that the price jumps instead.

A simple rule: once you are in the recommended window for your route and you see a price that is good for your budget and marked as low or typical by tools, it is usually better to book than to keep waiting.

How accurate are flight price predictions?

Accuracy depends on the route, season and the specific model, but a well-trained predictor that uses historical fares and current demand signals will typically be roughly right in 8–9 cases out of 10 on the routes it is confident about. On some stable, high-volume routes it can be even higher; on volatile routes (holiday peaks, sudden schedule changes) it will be lower.

The key point: a prediction is a probability, not a promise. It is useful as a strong hint about whether prices are more likely to rise or fall, but there will always be a slice of cases where reality does the opposite of what the model expected.

Can I trust AI flight price predictions?

You can trust them as a decision aid, not as a promise. Modern prediction systems use machine learning on large volumes of historical fare data, with features such as route, airline, days to departure, season and demand indicators, and they are good at spotting patterns that humans miss.

However, they cannot foresee shocks like sudden sales, strikes, capacity cuts or geopolitical events. The healthy attitude is to treat them like a weather forecast: they improve your odds of making a good decision, but there will always be days when reality behaves differently from the model.

What is a flight price predictor and how does it work?

A flight price predictor is a tool that estimates how likely it is that a fare will go up or down over a certain time window. In the background it collects historical prices for similar routes and dates, tracks how current fares are moving, and feeds features such as days to departure, airline, route, seasonality and sometimes demand proxies into statistical or machine learning models.

The output is usually a simple recommendation, such as “Buy” or “Wait”, sometimes with an expected price range and a confidence level. This compresses a lot of complex behaviour into something you can actually use.

Useful Links:

Flight Price Predictor

Book at the right time and save with AI-powered price predictions.

Check Price Prediction